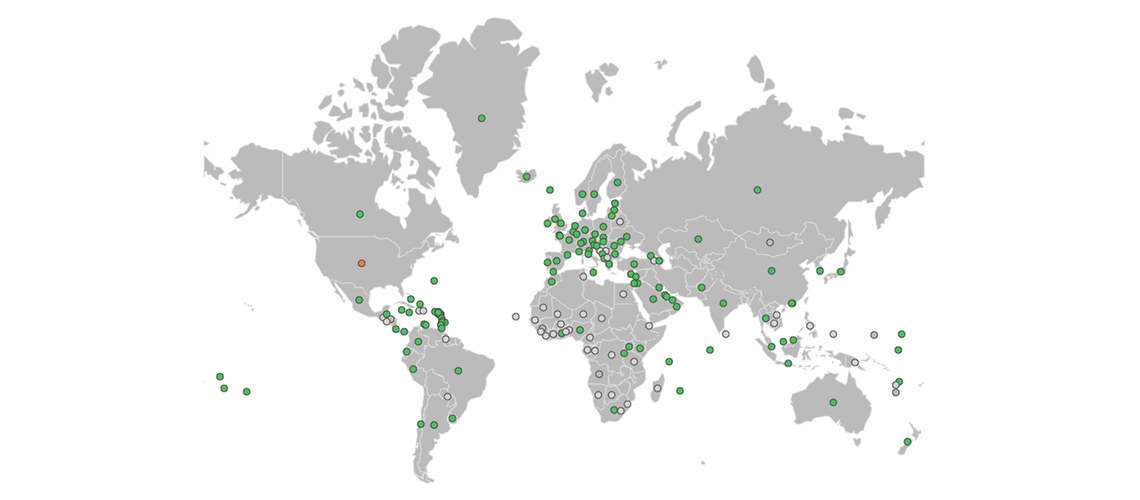

Automatic Exchange of Information January 2016 Introduction Cyprus – An early adopter of the Automatic Exchange of Informati

Spiramus Press | A Practitioner's Guide To International Tax Information Exchange Regimes - DAC6, TIEAs, MDR, CRS, and FATCA, By Grahame Jackson and Harriet Brown

Rogers: EU/OECD's Real Concern About CIPs Is Tax Competition, Not "Good Governance" - Part 1 - Investment Migration Insider

Developing countries' access to CbCR: Guess who's (not) coming to OECD dinner - Financial Transparency Coalition

OECD Agreement on Automatic Exchange of Financial Information Signed by 13 Countries during Recent Global Forum on Tax Transparency Meeting — Orbitax Tax News & Alerts

A fundamental tool for the Latin American Tax Administrations: the exchange of Tax Information | Inter-American Center of Tax Administrations

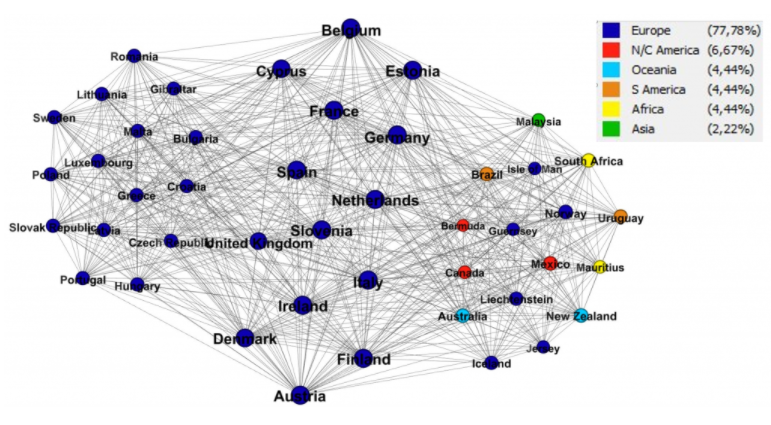

PDF) The Evolution of the Exchange of Information in Direct Tax Matters: The Taxpayer's Rights under Pressure